In a move that could escalate trade tensions and reshape the global electric vehicle (EV) market, the European Union (EU) has announced significant tariffs on Chinese electric vehicles. Brussels will impose additional duties ranging from 17% to 48% on imported Chinese EVs starting next month. This decision follows a comprehensive investigation into alleged subsidies provided by Beijing to its domestic EV manufacturers.

The tariffs, which will be added to the existing 10% duties on Chinese EVs, reflect the EU’s determination to counter what it sees as unfair trade practices. Valdis Dombrovskis, the EU trade commissioner, emphasised the necessity of these measures, stating that the influx of heavily subsidised Chinese electric vehicles threatens the viability of the European automotive industry. He cited evidence of subsidised loans, tax breaks, and cheap land provided to Chinese carmakers, which have enabled them to dominate the European market.

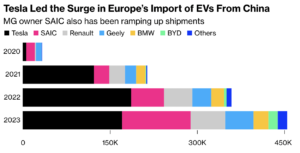

Note: SAIC brands include MG, Maxus and IM. Geely brands include Volvo, Polestar, Smart and Zeekr.

Among the affected companies are major Chinese manufacturers like BYD and Geely, which will face additional tariffs of 17% and 20%, respectively. European brands such as Mercedes and Renault, which manufacture EVs in China, will be subjected to a 21% tariff, while non-cooperative companies like SAIC, known for its MG brand, will bear the brunt of the highest tariff at 38%.

The decision has not been universally welcomed within the EU. Germany, Sweden, and Hungary have expressed opposition, fearing retaliatory measures from China that could impact their own automotive exports. German Chancellor Olaf Scholz has particularly voiced concerns about the potential for a trade war, highlighting the substantial number of German cars exported to China each year. Despite these objections, Dombrovskis insisted that there is broad support among EU member states for the tariffs, which are set to be finalised by July 4.

China’s response has been swift and vehement. The Chinese Ministry of Commerce condemned the EU’s actions as “ill-informed and lawless,” threatening to take all necessary measures to protect the interests of Chinese companies. Beijing has already launched an investigation into European liquor imports and hinted at possible tariffs on European agricultural products, aviation, and cars with large engines.

The implications of this tariff imposition are manifold. Economically, the EU stands to collect billions of euros annually from the growing sales of Chinese EVs in Europe. However, this move is expected to reduce Chinese EV imports by approximately 25%, according to estimates from the Kiel Institute for the World Economy. This reduction could be partially offset by increased domestic production within the EU, though this is likely to result in higher prices for European consumers.

From a geopolitical perspective, the tariffs are likely to exacerbate tensions between the West and China. The EU’s decision mirrors similar actions taken by the United States, which recently imposed a 100% duty on Chinese EV imports. These moves are part of a broader strategy to counter China’s dominance in green technology sectors, particularly as Europe and the US strive to meet their ambitious climate goals.

The increased tariffs on Chinese EVs will likely strain EU-China relations further, potentially leading to a tit-for-tat escalation in trade barriers. Such a scenario could disrupt global supply chains and impact industries beyond automotive manufacturing, affecting sectors like aviation and agriculture. Moreover, the higher costs associated with these tariffs could slow the adoption of EVs in Europe, complicating the EU’s efforts to transition to a green economy.

In the long term, these developments could drive Chinese manufacturers to increase their localisation efforts within Europe, establishing more production facilities to circumvent the tariffs. This shift could lead to a more fragmented and competitive market, with European and Chinese carmakers vying for dominance on an increasingly level playing field.

As both sides prepare for potential negotiations, the outcome of this tariff dispute will be closely watched by global markets and policymakers. The EU’s stance underscores its commitment to protecting its industries from unfair competition, but the risks of a broader trade conflict loom large, with significant implications for international trade and economic stability.

Stay informed on European political tensions and armed conflicts with our unique magazine. Subscribe for exclusive insights into current affairs and ongoing global issues.